Introduction:

When you need a loan, the last thing you want is to go through a lot of stress. You want a loan that’s fast, easy, and convenient. That’s where Avant comes in. We offer personal loans without the hassle. You can apply online in minutes and get a decision quickly. Plus, our loans are unsecured, so you don’t have to worry about putting your home or your car at risk. Apply today and get the money you need without all the stress.

1.What is Avant?

Avant is a personal loan company that aims to make borrowing money easier and less stressful. They offer competitive interest rates, no hidden fees, and a simple online application process. Avant is ideal for borrowers who need a quick, easy, and affordable way to get the money they need.

Read:

2.What are the requirements for an Avant personal loan?

To be eligible for an Avant personal loan, you must meet the following requirements: -You must be a U.S. citizen or permanent resident -You must have a valid Social Security number -You must have an annual income of at least $20,000.

-You must have a credit score of at least 600

In addition to meeting the eligibility requirements, you must provide some basic personal and financial information to complete your loan application. This includes your name, address, email address, phone number, employer information, and education history.

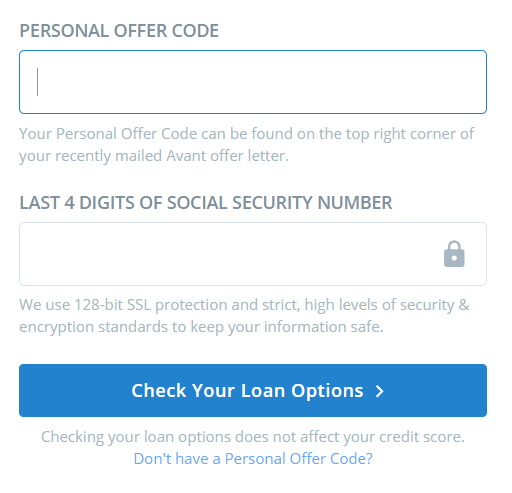

3.How does the application process work?

Applying for a personal loan with Avant is simple. You can apply online in just a few minutes and get a decision in minutes, too. Plus, there are no origination fees or prepayment penalties. So whether you’re looking to cover an unexpected expense or consolidate your debt, Avant can help. We understand that everyone’s situation is different, so we offer a variety of terms and rates to fit your needs. And our team of friendly experts is always here to help if you have any questions. So what are you waiting for? Apply today!

4.How quickly will I receive my loan?

You can receive your loan as soon as the next business day. We know that you need the money as soon as possible, so we work hard to get you the funds you need as quickly as possible. Our quick and easy online application process means you can apply anytime, anywhere.

5.What are the repayment terms?

When it comes to the repayment terms, Avant is straightforward to understand. You’ll have the option to choose a repayment term between two and five years. This gives you plenty of time to pay off your loan without feeling rushed. And if you happen to need a little more time, no problem! You can choose to extend your repayment term for an additional fee. Plus, there are no prepayment penalties so you can pay off your loan early without any extra fees.

Conclusion:

At Avant, we want to make the loan process as stress-free as possible for our borrowers. We have a team of friendly and knowledgeable loan specialists who are here to help you every step of the way, and we work hard to get you the best possible rates. We also offer repayment terms that are tailored to fit your budget, so you can breathe a little easier knowing that your loan is manageable. Apply for an Avant personal loan today and get the money you need without all the hassle.